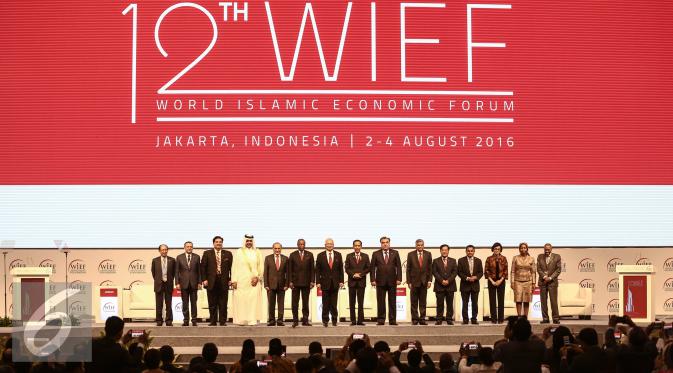

Hawzah News Agency- The 12th World Islamic Economic Forum (WIEF) ended on a high note in Jakarta, Indonesia with not only 10 memoranda of understanding (MoU) worth $899.6 million signed, but creative arts producers and performers were provided with the knowledge to further their interests into more income-generating activities, as well.

Meanwhile, towards the closing ceremonies and from the “Restructuring SMEs and Improving Credit Access” panel discussions, Dubai Islamic Bank Chief Executive Officer Adnan Chilwan supported the “people’s owned enterprises” or Bumra concept and approach of PT Pertamina (Indonesia government-owned oil and gas company) president commissioner Tanri Abeng.

The Bumra institutionalizes all cooperatives and micro-small-medium enterprises for more access to cost-effective funding, production, marketing and distribution channels.

Chilwan said the Bumra approach needs government support.

He said banks will seek government-back guarantees before lending money to the corporatized cooperatives and MSMEs.

In her closing ceremonial speech, Indonesian Finance Minister Sri Mulyana Indrawati highlighted the conclusions of the Aug.2 to 4 summit with the theme “Decentralizing Growth, Empowering Future Business.”

These are: addressing the lack of knowledge about Islamic financing products and the lack of ability for financial companies to see the long-term prospects offered by halal-related businesses; strengthening long-term infrastructure financing mechanism including asset-backed securities, thereby building better collaborations between grassroots businesses and mainstream industries.

She said the signed MoUs were in the fields of real estate, medical facilities, halal industry, business franchise, Islamic financing and capital markets.

On the other hand, according to research from Thomson Reuters on the sidelines of the three-day event held at the Jakarta Convention Center, “Islamic finance is considered the most developed sector within the various pillars of the Islamic economy.

“It was projected that Islamic finance assets would grow to $3.2 trillion and Islamic banking reaching $2.6 trillion by 2020.”

From the arts and culture arena through the Marketplace of Creative Arts platform, the modern Islamic-themed movie “Khalifa” was shown.

End.

Your Comment